Nvidia is far from the only stock to see huge declines in Q1

__________________________________________________________________________________

Tuesday, February 4th

“Given that external reality is a fiction, the writer’s role is almost superfluous. He does not need to invent the fiction because it is already there.”

–J. G. Ballard

__________________________________________________________________________________

__________________________________________________________________________________

Markets Today

🌏 Asia-Pacific: Down

🇪🇺 Europe: Up

🇺🇸 United States: Up

🛢️ Oil: Down

⚡Crypto: Down

__________________________________________________________________________________

Let’s check in on the state of earnings, shall we? The tech companies have been doing fairly well. Last night, PLTR beat all estimates on earnings per share and revenue, and gapped up an absurd amount at open today.

The AI defense contractor is now up 53% over the past 12 months and 40% year to date. Meanwhile, META posted 20% year over year revenue growth last week, with a huge increase in net income. Wwe have Google up to bat after the market closes today, but I expect it will be more of the same.

The thing is folks, the major tech companies are the market. It’s going to be very hard for us to see sustained downward moves while tech companies continue to be so strong. So, Thesis #1 is that tech companies will continue to outperform on earnings.

Now, the question becomes: With that belief, how should a trader play earnings? Calls? Well, regular puts and calls are typically not a winning strategy around earnings. Most traders lose an average of 14% per trade when they try and do that.

A much better strategy IMO is one I detail in this training right here. Because what happens with earnings? We see a massive spike in volatility before, then a decline in volatility after. What I’ve done is created a way that traders can target these “volatility flushes” to target nice little single day trade wins.

Right now, we’re sending out about 7 trades per week with this earnings strategy. If you want to get in before the next trade, go here to see how it works.

____________________________________________________________________________

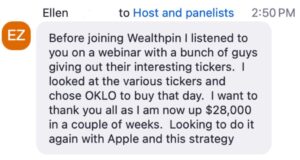

Testimonial of the day