__________________________________________________________________________________

Get my #1 crypto earnings play for FREE before this week’s major move

__________________________________________________________________________________

Tuesday February 11th

__________________________________________________________________________________

“I don’t know why people expect art to make sense. They accept the fact that life doesn’t make sense.”

– David Lynch

__________________________________________________________________________________

Hey everyone, I thought today I could talk about an interesting little daily income strategy on SPX. If you’re a part of some of my paid services, you’ll know that we trade SPX a few times a week.

However, this strategy is different from the one we trade, but it still has legs.

Statistically, SPX moves within a 1% range the vast majority of the trading days. So, if you establish your levels properly for the day, you could simply sell a credit spread each day and collect income.

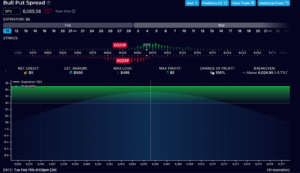

For instance, look at today’s action:

It’s pretty slow movement. But as of the writing of this email at around 1:35 PM, we can be pretty certain that SPX will stay above 6025. Opening a 0DTE bull put spread at 6025/6020 would give you a $5 credit to your account. That’s not great, especially considering that the max risk for the position is $495.

Meaning if SPX dropped below 6025, you run the risk of losing a lot more than you could make. However, looking at the probability of profit, you can see that it’s at 100%

Now, this doesn’t guarantee that the trade will workout. Even 100% odds aren’t guaranteed. The point I’m trying to make though is that this trade is fairly low risk. Especially if you open it up late in the afternoon, when the levels are largely established.

And the cool thing about SPX is that it’s cash-settled, meaning if the trade does go against you, you will never be assigned shares. Also, since this is 0DTE, you can just let the spread expire without having to close out your position before the end of the day. So, for smaller accounts, they can avoid triggering the PDT rules.

Now, there’s two ways to juice the profit potential. One, you could just edge up your contracts. If you open 10 contracts, you’re looking at $50 for the day in profits. Not much, but these are daily contracts, so say you did it four times a week? That’s an extra $200 per week.

Or you could go closer to the money. This will increase the risk but also the premium you collect. For example, the 6035/6030 put spread would allow you to collect $10 per contract. So, double. And the probability of profit would drop to…99%.

I’ve made these types of trades when I’m supremely confident in my levels. Maybe it will work for you…maybe it won’t. It’s not the most optimal strategy by any means due to the high risk:reward profile.

But I’m here to show you the variety of trading strategies out here. And this one can work — you just have to be confident in the levels.

-Alex

____________________________________________________________________________

____________________________________________________________________________

Testimonial of the day

____________________________________________________________________________

To Better Trading,

Alex Reid