🚨 I’ll be live at 2:30 p.m. ET with Geof Smith🚨

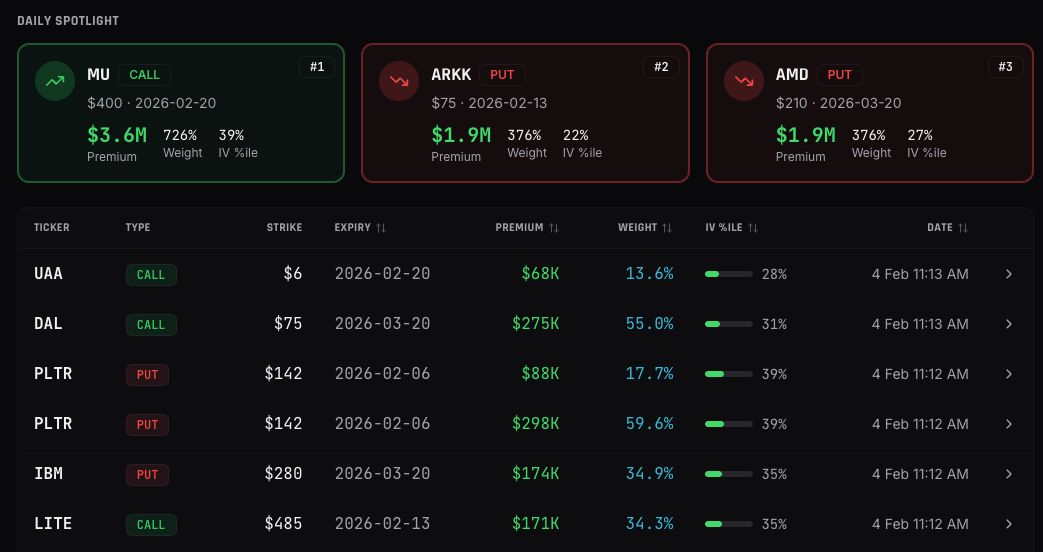

We’ll cover whether it’s time to put high beta to bed whether I’ll finally buy puts on PLTR and some fun earnings plays [tap to join us for Profit Panel]

Sometimes the market hands you a textbook case of disruption, and Unity Software’s (U) brutal 26% drop Wednesday is exactly that.

This wasn’t a normal earnings miss. U built its entire value proposition on solving a hard problem: Making game creation accessible without needing to master C++, a very esoteric coding language that historically made game development a niche skill set.

But the ground shifted fast. Alphabet (GOOGL) rolled out an AI-enabled game creator that was pretty dang good.

You can prompt it and it’ll create what you want. No complex code. No steep learning curve. Just describe the game and watch it materialize.

That kind of innovation doesn’t just challenge a business model — it erases the moat.

When a user can build something in minutes that previously required specialized tools and technical knowledge, the obvious question becomes: Why pay U when you can do it very cheaply yourself?

The Real Tell Was in the Guidance

The guidance was particularly bad, and that’s often more important than whether they beat or missed the quarter.

Management knows what’s coming better than anyone, and when they pull numbers down this hard, it usually means they see the competitive landscape changing in real time.

This isn’t happening in isolation. It’s tied into the broader software sell-off, and plenty of traders are looking at these crushed names thinking the same thing: They’re already so sold off, it feels like they can’t go any lower, can they?

That sentiment is exactly what makes sector rotations so tricky. The pain can be deeper and longer than seems reasonable.

AI is removing complexity at a pace premium software companies can’t keep up with.

When your entire pricing power comes from simplifying something hard and AI suddenly makes that task effortless, the value proposition doesn’t just weaken — it collapses.

What This Means for Your Watchlist

The lesson here isn’t about U specifically. It’s about understanding when a business model relies on complexity and when AI is about to steamroll that complexity into dust.

If you’re holding software names that depend on being the easy button for something technical, ask yourself: Could AI do this job for pennies on the dollar?

If the answer is yes, you may want to adjust your sizing or tighten your stops long before the next earnings call forces the issue.

U’s collapse is a signal. The software sector is facing a reckoning, and the bloodbath doesn’t look done.

Stay alert, stay flexible and don’t assume a stock is too beaten down to fall further.

👉 Click here to join Profit Panel at 2:30 p.m. ET on weekdays!

To better trading,

Alex Reid

WealthPin

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram: https://t.me/+MKMN30kDmVkwMDdh

- YouTube: http://www.youtube.com/@heywealthpin

Important Note: No one from the WealthPin team will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. 100 Traders Needed To Test a Brand-New Trading Breakthrough

100 Traders…

That’s all I need to help test a new system I’m calling AlphaOptions.

I’ve been stress-testing it with my team for months, and now I’m opening a small window for a limited group of traders.

You don’t know what AlphaOptions are yet — and that’s intentional.

Over the next few days, I’ll break down how it works and share some of the results we’ve already seen.

Here’s what I can say for now…

These are a small set of options setups designed to target returns of 50%, 100% or even 200%+ in days — sometimes with minimal movement in the underlying stock.

This Sunday, I’ll be live with Graham Lindman for a full AlphaOptions demo.

And although I can’t make guarantees when it comes to trading…

But if you’ve followed my work, you know how seriously I take anything I release.

If you want to be among the first traders to test this new engine with me, register now and prepare to join Graham and me live this Sunday.

Get Early Access to AlphaOptions

Disclaimer: The profits and performance shown are not typical and you may lose money. Since this is a tool designed to help traders make informed trading decisions the results will vary for each individual user as there are multiple trades to choose from. We cannot guarantee any future results. What you will see are some of the best examples over the last few months. There were bigger winners, there were smaller winners and there were losers.