>>> We’ll do some live trading, cover stocks making interesting moves as usual and more — Profit Panel starts at 2:30 PM ET, click HERE to JOIN Live! <<<

I’ve been tracking something unusual, and it’s not coming from CNBC or your broker’s research desk.

I’m talking about open source intelligence — the kind you can pull from X, aka Twitter, if you follow the right accounts — and what I’m seeing has me taking a small, speculative position on United States Oil (USO).

Here’s the setup: We’re moving a massive amount of military equipment into forward deploying bases in the Middle East.

Refueling tanker planes and moving troops.. the kind of activity you don’t do unless something is about to happen.

It’s the same pattern we saw with Venezuela when we moved equipment right off the coast — you don’t make moves like that unless something is coming.

And if you remember the summer strike on Iran’s nuclear facility, Trump went quiet for weeks, then we struck out of nowhere.

I don’t trade on rumors. But I do trade on patterns, and this pattern has my attention.

If we strike Iran, oil supply gets disrupted so USO is going to move fast. So I’m taking a small hedge — a Hail Mary play, not a core position — using out-of-the-money (OTM) call spreads.

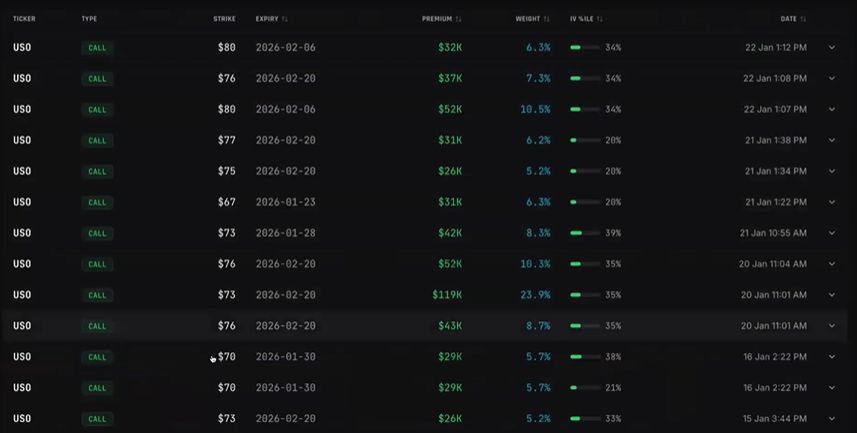

What I’m Seeing in the Flow

USO has been showing steady accumulation for days, and it’s been moving up since Jan. 16.

When I look at the options flow, I’m seeing something I call a call wall…

When you see multiple strikes lighting up across different expirations, it’s a good signal.

That’s not a single trader making a bet. That’s positioning across contracts, and it creates gamma pressure that can push prices higher if buyers stay engaged.

The trade I’m looking at? The $76-$77 call spread for Feb. 20 at around 17 to 18 cents.

It gives me time for the story to develop without betting the farm. If nothing happens, I lose pennies. If we see action, this thing could pop like nobody’s business.

One member of our group shared intelligence suggesting a strike could happen by Jan. 31. I can’t verify that, but the troop movement is real and the flow is real.

That’s enough for me to take a small, defined risk.

How I’m Managing This

Let me be clear: This is not a high-conviction trade. It’s a hedge.

A speculative play based on observable military movements and historical playbook.

I’m treating this as insurance, not a core position, and I’m sizing it accordingly.

If you decide to follow along, don’t go ham on this.

Keep it small. Keep it defined.

And understand that the reason I’m taking it is pattern recognition, not certainty.

Trump used the same playbook with Venezuela and the first Iranian strikes — quiet and then sudden action.

If that repeats, USO moves. If it doesn’t, we’re out a few bucks.

I’ll be walking through more setups like this — where open-source intelligence meets flow data and chart structure — on the next Profit Panel. If you’re not joining live, you’re missing the real-time decision-making that turns observation into action.

👉 Click here to join Profit Panel Live, Weekdays at 2:30 p.m. ET!

To better trading,

Alex Reid

WealthPin

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram: https://t.me/+MKMN30kDmVkwMDdh

- YouTube: http://www.youtube.com/@heywealthpin

Important Note: No one from the WealthPin team will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

PS. We Beat Wall Street’s Finest Hedge Funds Last Year…

Thanks to the Wave Software, we’re able to get in on some of the juiciest setups every single day.

You know you’re doing something right when you crush Wall Street’s finest hedge funds in yearly ROI.

It basically scans the market every single morning for stocks that have been building momentum for days or weeks and are finally ready to move rapidly.

Which means, you’re not just able to flag the one stock that’s most likely to move massively each day…

This powerful tool goes on to provide the exact options criteria to take advantage of the stock’s move for more than decent payouts.

That’s why I was excited when Lance Ippolito demanded I bring the good news of the Wave Software to his audience.

So mark your calendars!

Because I’ll be live with Lance Ippolito at 7 p.m. ET on Sunday for a full and complete breakdown of the all-powerful Wave Software.

If you’re yet to see what lies behind what looks to be a simple dashboard…