🚨 I’ll be live at 2:30 p.m. ET with Geof Smith🚨

Markets at a crossroads: After tariff rejection, should you lean into retail or brace for conflict — and what signals matter most now? [tap to join us for Profit Panel]

The market’s been giving us signals all week if you know where to look.

Star Bulk Carriers (SBLK) appeared on both the Free Ride Scanner and my proprietary scanner, which immediately told me something was moving.

When a name lights up on multiple feeds like that, it’s worth a closer look.

SBLK was already up big, and when I pulled up the options chain, the flow pattern jumped out.

There was heavy at-the-money and in-the-money call activity for the 0DTE expiration, which tends to happen only when someone thinks a near-term move is coming.

On top of that, the put side was almost silent, which showed one-sided conviction.

The broader backdrop matters here. A lot of what we’ve traded this week has been driven by Iran-related geopolitical tension.

When shipping lanes are at risk or supply chains tighten, dry bulk carriers can move fast. It’s the same dynamic we’ve seen with other shipping names making strong post-earnings runs.

Why Shipping Fits the Moment

SBLK operates in the dry bulk sector — phosphate, iron ore, whole grain and steel.

These are industrial materials tied to hard assets, which have been the strongest theme in this geopolitical environment.

Shipping demand is sensitive to disruption, and tension in the Middle East only amplifies that sensitivity. The sector already had momentum, with multiple peers breaking higher.

So when SBLK began flashing across my scanners, it lined up perfectly with the trades we’ve been leaning into this week.

How I Structured the Trade

Before entering, I wanted to check whether the options were even reasonably priced.

My first thought was simple — are these expensive? I hadn’t looked at the chain yet.

Once I pulled it up, I realized the calls were only about $0.60 to $0.70, which made the trade even more attractive.

I took March 20 expiration, $26 strike calls, aiming to get filled around $0.54 to $0.55. The price was moving quickly, and I entered at $0.57.

Given the affordable premium, it made sense to take a defined-risk shot while the sector was hot.

SBLK has earnings on Wednesday, but the plan isn’t to hold into that. We’ll likely look to exit in the next few days as the theme plays out.

This isn’t an earnings trade — it’s a positioning trade built around shipping momentum, geopolitical catalysts and cheap call premiums that give us leverage without unnecessary exposure.

If a trade doesn’t fit your approach, you never have to take it.

These are simply ideas based on what I’m seeing.

When the flow is clean, the sector is aligned and the premiums are cheap, I’m going to take my shot and let the market tell me if I’m right.

👉 Click here to join Profit Panel at 2:30 p.m. ET on weekdays!

To better trading,

Alex Reid

WealthPin

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram: https://t.me/+MKMN30kDmVkwMDdh

- YouTube: http://www.youtube.com/@heywealthpin

Important Note: No one from the WealthPin team will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

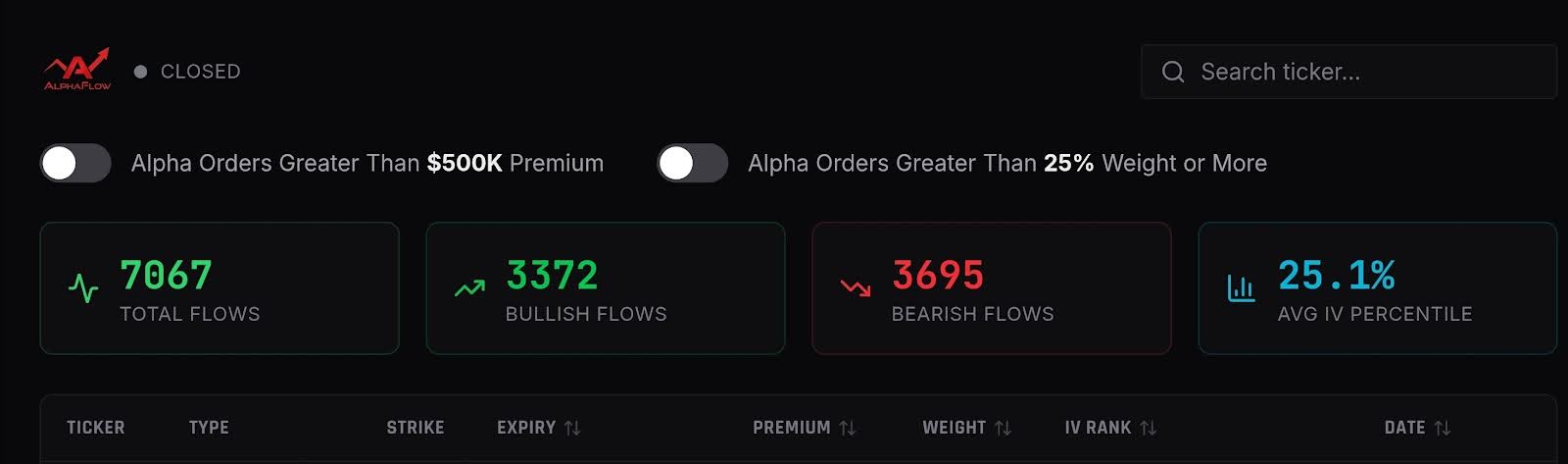

P.S. 7,000+ Signals From the AlphaOptions Dashboard in Only a Few Days?

Don’t let it scare you.

I want to take you through the entire dashboard and show you exactly what to look for when you deploy this power trading engine.

Then I’ll invite you to join the AlphaOptions Experiment — with a chance to secure FREE access for an entire year.

Disclaimer: We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. The profits and performance shown are not typical and you may lose money. Since this is a tool designed to help traders make informed trading decisions the results will vary for each individual user as there are multiple trades to choose from.